Healthcare That Powers Performance and Productivity

For the creatives and builders who make the world a better place.

About Us

We're a creative employee benefits agency based in Hood River, Oregon.

Our reason for being is simple. We have a dysfunctional healthcare system that doesn't work for professionals or their employers.

Health insurance premiums are crazy ($812 average per month for employee only). It takes forever to see a doctor (average 35 days). And if you see the doc- you face the waiting room, meh staff, paper forms, and you may or may not get your issue resolved. And then comes the bill, because wait, the health coverage that you pay $812 per month for comes with a huge deductible.

We believe that change runs through employers who demand a different way. And if this is you, let's work together.

Here's our 4-step process:

1. Optimize health insurance. Self-insurance, ICHRA, and level funding are all alternatives we can explore to cut your costs.

2. Offer an HSA Plan. Give your team real dollars they control for care they actually want.

3. Add an AI Health Service. Faster answers. Fewer clinic visits, and real savings. It's the bridge between "Dr Google" and the doctor's office, shifting care from sick-care to smarter, proactive health.

4. Constantly iterate and improve. Measure results and continue to bring in innovations that work.

Cut Health Insurance Costs by 10-50%

Explore alternatives like ICHRA, level funding, or self-insurance to save.

ICHRA

ICHRA stands for Individual Health Coverage Reimbursement Arrangement.

It's ACA compliant group sponsored coverage that works like a 401k for healthcare. You set a defined fixed amount per month to reimburse employees for their individual coverage.

✅ Employees select the carrier and plan they want

✅ Buy up for lower deductibles, buy down for an HSA compatible plan

✅ No participation requirements- works for 1 to 300 employees

✅ Tax advantages for employer and employee

✅ Portable- coverage stays with the employee and gets you as the employer "out of the game"

✅ Choose different amounts for different classes (salary v hourly)

Level Funding

Level funding is a newer option that is a hybrid between fully insured and self-insured plans.

With level funding, you pay a fixed monthly premium. If you have good claims experience (common when using our direct health solutions) you get a refund from the insurance carrier at the end of the policy term.

Self Insurance

Not as scary as it sounds! You pay each individual health claim as they come in- according to a plan design customized for your workforce. But- you stop paying when claims reach a specific threshold. This is called stop loss insurance. You pay a premium for stop loss. A common threshold is $25k for an employer with 100 people.

If you have a healthy workforce and have 100+ employees, this is the best way to sharply decrease your employee health costs.

Let's Talk Health Savings Accounts

Recent federal legislation has expanded HSA compatibility.

Key Features of HSA Plans

1. Funds owned by employee and can be accrued and invested.

2. Can be used for services not covered by insurance (like orthodontia, OTC meds).

3. All bronze plans and some plans with co-pays are now HSA compatible.

4. Telehealth and direct primary care no longer subject to deductible for HSA plans.

We recommend all employee benefit packages come with an HSA plan option.

Self-Serve Primary Care

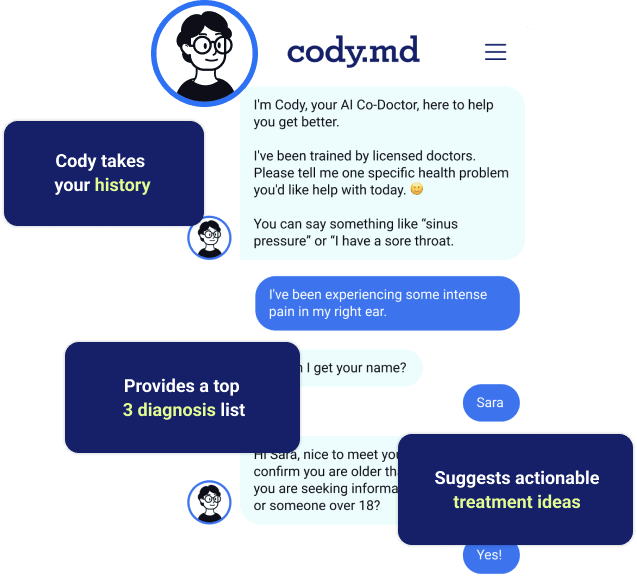

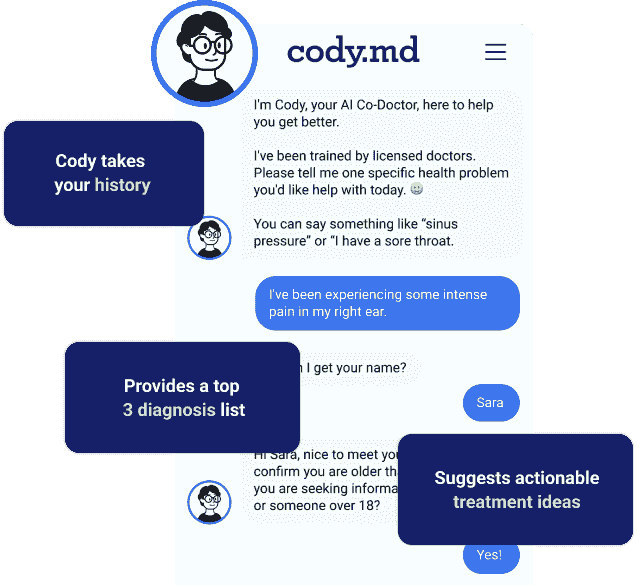

Cody, the leading AI doctor, is here to help with your financials and operations.

1. Cut your claims costs (doctor avoidance, smarter routing to cost effective care).

2. Get your people well and back to work faster.

3. Improve individual energy and brain power for better performance on critical tasks and projects.

4. Private talk therapy to relieve stress and anxiety.

FAQs

Answers to common questions and the hows and whys.

How much does it cost?

Why is this approach new to me?

Who is Maker and Cody?

Let's Chat

We're always up to learn about your unique challenges and goals and would love to demo our solutions for you.

Copyright 2026, Impossible Benefits, LLC. All rights reserved.

Licensed to sell health insurance in Oregon and Washington. Qualified to advise on self-insured employer plans nationwide.